Pay raise calculator with overtime

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Note that the employee should receive the total payment on their usual payday.

4 Ways To Calculate Annual Salary Wikihow

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be.

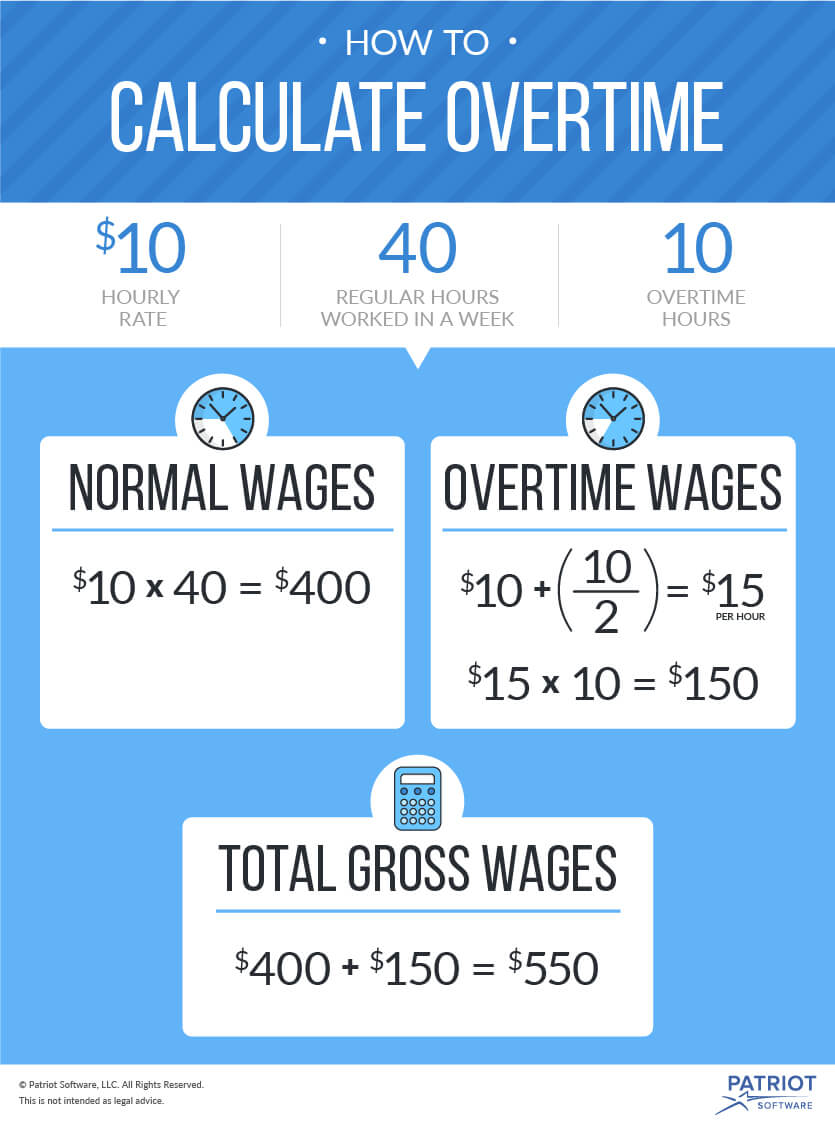

. Add the overtime pay to the employees standard pay. Use monthly gross payment amount. The overtime calculator uses.

The next step is to calculate the amount you should pay the employee after the raise. This employees total pay due including the overtime premium for the workweek can be calculated as follows. An online time and a half calculator will compute the time and a half double and tripe overtime pay rates using the following steps.

Biweekly Biweekly gross pay x 26. Wage for the day 120 11250 23250. 1000154 1500 4 6000.

Enter your pay band number Enter S if youre in an Occupational or GovEx pay band Your total percent increase Your new hourly pay rate. The calculator includes rates for regular time and overtime. Pay rates include straight time time and a half double time and triple time.

Enter your hourly pay rate. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for. Depending on the employer and its incentive policy the overtime multiplier may be greater than the laws.

Add the overtime pay to the employees standard pay. RM50 8 hours RM625. 35 hours x 12 10 hours x 15 570 base pay.

Regular pay of 15 8 hours 120. 570 45 total. Next enter the hours worked per week and select.

Firstly put your regular pay and work time as per. Unless exempt employees covered by the Act must receive overtime pay for hours. Enter your current pay rate and select the pay period.

One day this employee works overtime for a total of 2 hours. The federal overtime provisions are contained in the Fair Labor Standards Act FLSA. Dont forget that this is the minimum figure as laid.

Twice monthly gross pay x 2 pay periods. Divide the employees daily salary by the number of normal working hours per day. 8000 6000 14000.

Overtime pay of 15 5 hours 15 OT rate 11250. Annual gross pay 12 months. Calculate overtime pay for a monthly-rated employee.

In addition a rate of nothing is included for people who. Follow the simple steps below and then click the Calculate button to see the results.

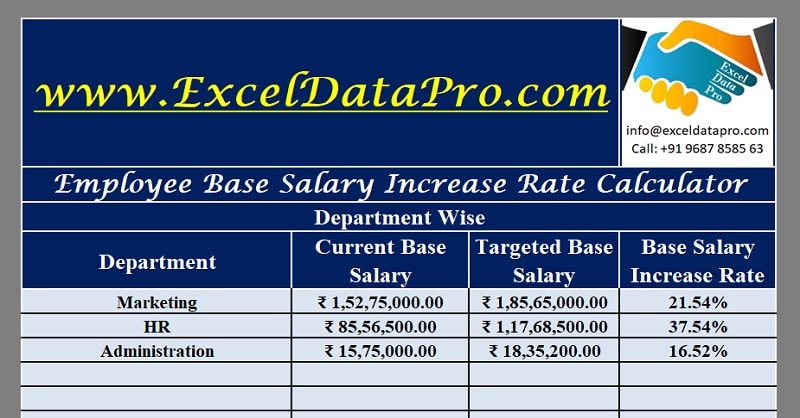

Download Employee Base Salary Increase Rate Calculator Excel Template Exceldatapro

N2yunsaxeopewm

Hourly To Salary What Is My Annual Income

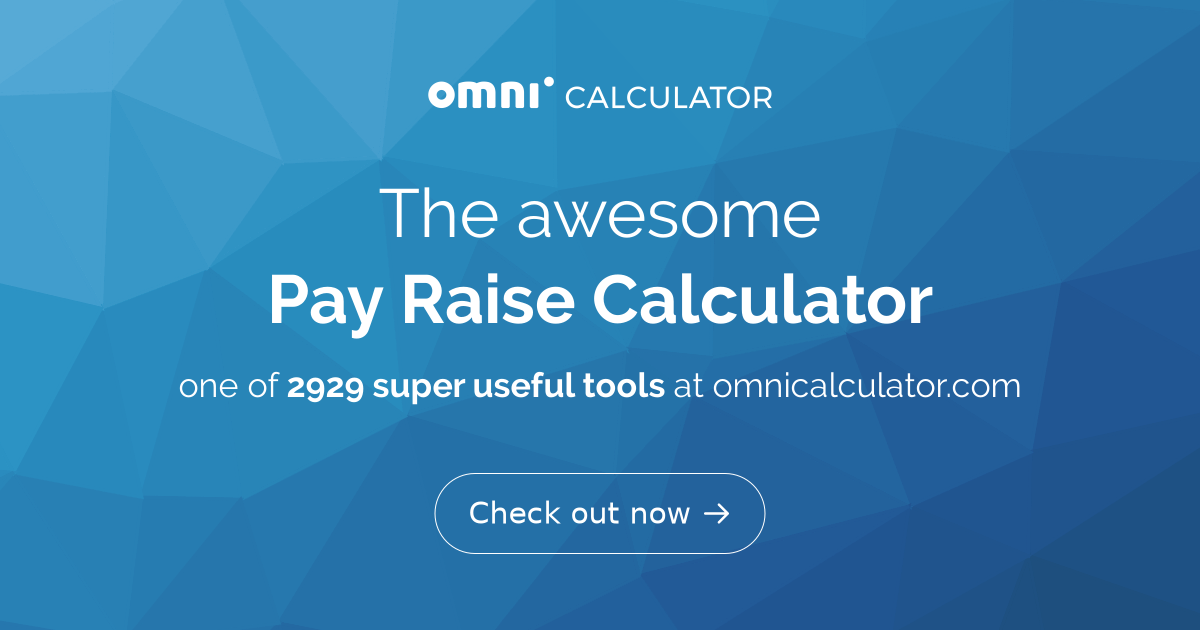

Salary Calculator App

Overtime Calculator

Overtime Calculator To Calculate Time And A Half Rate And More

How To Calculate Net Pay Step By Step Example

Pay Raise Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

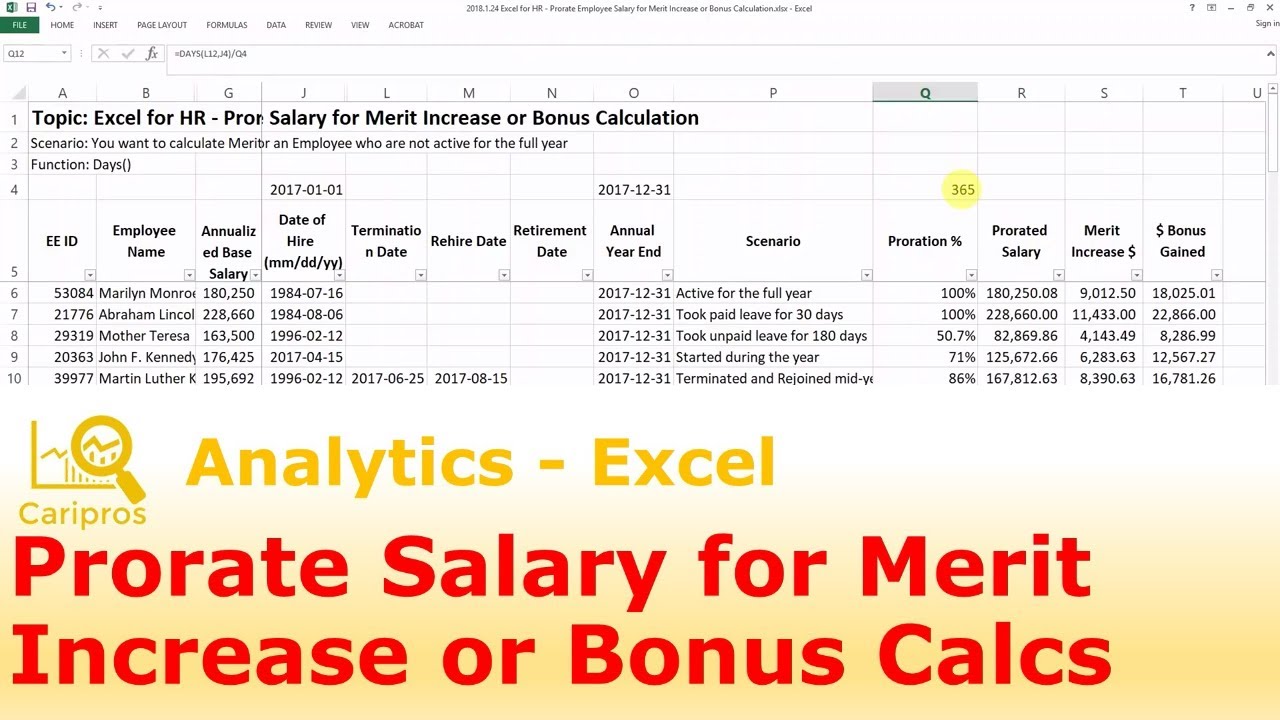

Excel For Hr Prorate Employee Salary For Merit Increase Or Bonus Calculation Youtube

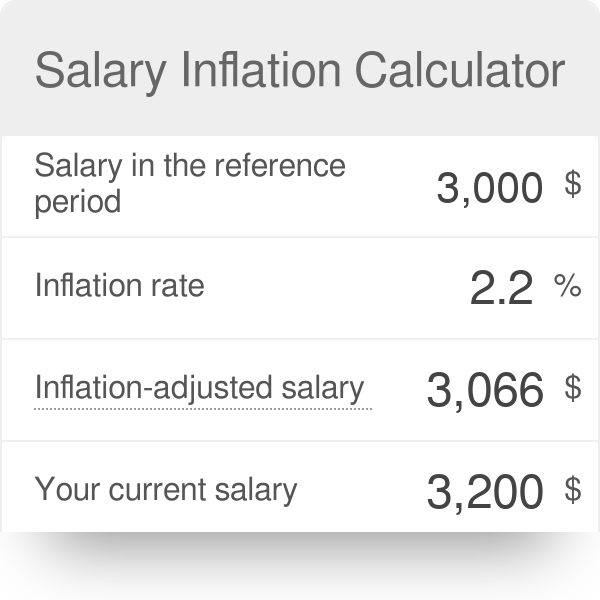

Interactive Salary Inflation Calculator Blog

How To Calculate Retroactive Pay Payroll Management Inc

Pay Raise Calculator

Time And A Half Calculator Online 56 Off Blountpartnership Com

Salary Inflation Calculator

Pay Raise Calculator

Salary Calculator App